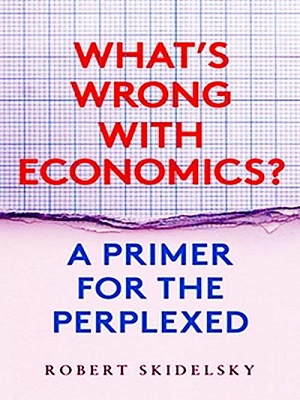

The need for economists to think about economics became apparent after the global financial crisis of 2007–2008. Few economists predicted the crash; more damningly, few envisaged the possibility that such a collapse could occur, any more than the crash of an algorithmic system. Students of economics asked: what is the point of studying economics if it can’t tell you what is going on, or offer policies to prevent bad things from happening? For what happened was the worst economic crisis since the Second World War. Terms to describe it go from the Lesser Depression to the Great Recession. The roots of this failure do not lie with the incompetence or inattention of individual economists, but deep within the way economics is done – its methodology.

This may sound dry and boring, but the methods of economists are key to understanding how and why economics goes wrong. Neoclassical economics has developed a peculiar method for studying the economy, and the use of any other method is not regarded as economics. In other words, the subject matter of economics is defined by the neoclassical method. Models based on this method allow for only a limited range of possibilities. Events which might occur outside this range are not picked up on economists’ radar screens. Models which show financial markets to be efficient – as most of them did – will not give you the collapse of 2008. The spate of papers offering explanations of the crash came after the crash. We now learn that, with a bit of uncertainty, ‘multiple equilibria’ can be ‘endogenously’ generated. But there was no ‘uncertainty’ before the crash, only insurable risk. So, this book aims to discover why the most influential discipline for making public policy is so often cut off from reality.